Evergreen Money

Product Name: Evergreen Money

Product Description: Evergreen Money is a high yield checking account that sweeps your funds into Treasury Bills to get you a higher yield. The interest is exempt from state and local taxes, which makes the effective yield even higher.

Summary

Evergreen is a fintech company that uses the banking services of Coastal Community Bank. Founded in 2023 by Bill Harris, who founded Personal Capital and was CEO of PayPal, they offer a high yield checking account that leverages Treasury bills as an investment vehicle.

Pros

- High yield for checking account

- Interest is exempt from state & local taxes

- No incoming wires fee

Cons

- 0.03% monthly fee

- $10,000 minimum balance

- Login with Passkey only

With interest rates at the highest they’ve been in over twenty years, we’re now seeing a lot of fintech companies offering banking services that look to increase yield by investing in Treasury bills.

Evergreen Money is the latest company to do this. They’re offering a high-yield checking account that puts your money into U.S. Treasury bills and then pulls them out when you access your money, such as when you swipe your debit card.

The yield is currently 5.35% APY but subject to change since they are being swept into T-bills.

🎩 Tip of the hat to Jonathan at My Money Blog for being the first (I saw) to write about Evergreen.

Table of Contents

Who is Evergreen Money?

Evergreen Money is a fintech so they are not themselves a bank, they get their banking services through Coastal Community Bank, FDIC insured #34403. Coastal Community Bank is one of those white-label banks that offer their services to fintechs you’re likely familiar with, like Aspiration, BlueVine, Prosper, Albert, etc.

Treasury bills are held in an SIPC-insured brokerage account with Jiko Securities. Jiko themselves offer a banking service that does something very similar, though their homepage just has a contact us form and is sparse on details.

Evergreen Money was founded by Bill Harris, who also founded Personal Capital (now Empower) and was CEO of PayPal and TurboTax.

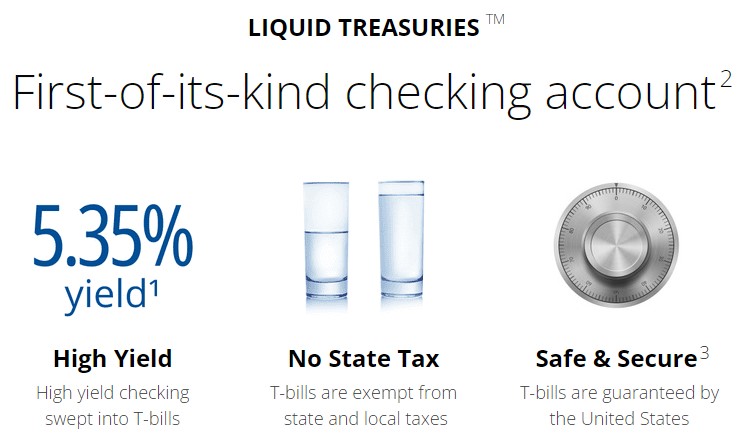

Evergreen Liquid Treasuries

They have a checking product called “Liquid Treasuries” that offers a 5.35% APY – already a compelling offer on its own. They do this by sweeping your funds into U.S. Treasury bills to get the higher yield.

And, since the interest comes from U.S. Treasury bills, is is exempt from state and local taxes. In Maryland, the state taxes interest income at 6.00%. This means that a 5.00% APY that is exempt from state taxes is equivalent to a ~5.32% APY. It’s still subject to federal income taxes, but so is simple bank interest.

The account does charge a 0.03% monthly fee, which makes the annual fee 0.36%., and there is a $10,000 minimum deposit to open.

Those familiar with FDIC insurance are probably wondering how T-bills could be insured – they aren’t. The money in your checking account is insured but when it’s put into Treasury Bills, it’s moved to a brokerage account. That brokerage is covered by SIPC insurance and the bills inside are “guaranteed by the full faith and credit of the United States” with no limit.

🤔 I’ve noticed that their APY language on the site varies from place to place. Sometimes it says 5.39%, sometimes it says 5.35% – I think that’s a function of the more fluid nature of T-bills and that they’ve chosen to use images rather than text. It makes it slower to update (and more places to update).

$250 with $10,000 Deposit

As a “charter client,” they are offering a $250 welcome gift when you fund your account with $10,000 (the minimum for an account anyway). You have until 6/30/2024 to take advantage of the offer and the bonus posts 15 days from the date of deposit.

The terms don’t say how long you need to keep the funds there to get the bonus (yet?).

Evergreen Account Opening Process

You can start the process on a computer but then they ask for your phone number and the application continues there. They ask the typical questions you’d expect from a bank – name, birthday, address, Social Security Number, employment status, etc.

Once you get through that, you’re asked to link your bank and fund it with at least $10,000. The linking process did NOT use Plaid, which surprised me. They just have you enter your ABA routing number and checking account number.

And just like that, the Evergreen Checking Account is up. It took all of five minutes.

To complete the process of opening a Liquid Treasuries account, you have to verify additional information and send in one of the following:

- Lease Agreement (must be for valid time frame and signed)

- Mortgage (must be valid time frame)

- Deed (must be valid time frame)

- Bank Statement (must be last 45 days)

- Credit Card Statement (must be last 45 days)

- Utility Bill (must be last 45 days)

- Pay Stub (must be last 30 days)

I sent in a utility bill since that contains no sensitive information. I think this is for identity verification purposes though I’m not sure why a utility bill counts. I suppose it’s less annoying than asking me to take a photo with my government ID!

Login by Passkey Only

One weird quirk about Evergreen is that to login, you must use a passkey. No passwords!

I log in on my phone (yes, this violates my rules on secret email logins) and so for a passkey I can use my face.

It’s a little weird to not have an app or an email/password combination login. I’m OK with it but I can see how it could be a turnoff.

What are some alternatives?

This offer is unique in its simplicity – you get a high yield checking account that is accessible by debit card. I’m not familiar with any other fintech that offers this.

But if that flexibility is less important, this account is really similar to money market funds. If you compare this with your typical money market fund, like Vanguard Federal Money Market Fund (VMFXX), you get similar yields though not all of it is state and income tax exempt.

As of this writing, VMFXX has a yield of 5.28% with an expense ratio of just 0.11%, a third of Evergreen’s fee. 21.6% of its holdings are U.S. Treasury bills, 32.30% in U.S. Government Obligations, and the rest are in Repurchase Agreements. Not all of those are exempt from state and local taxes.

If you want an easy way to buy U.S. Treasuries, you could also look at Finvest. I don’t know much about them and haven’t used them but they popped up on my radar and I will take a look soon. Interestingly enough, they also charge a 0.03% per month fee.

Is this a good deal?

As long as T-bill rates remain high, it’s a good deal because the interest is state and local tax exempt. As rates lower, we’ll have to see how T-bill rates compare with other options.

The $250 is a nice, especially given how sparse the terms are, and getting a high yield with no extra effort is appealing. The fees are reasonable, considering how little work you have to do, and the yield is exempt from state and local taxes so it’s easily beating what I’m getting from by current bank (Ally, which has a yield of 4.20% APY).

For now, I thought it was appealing enough to get an account for myself.

I’ll update this post with any additional thoughts as I use the account.

Other Posts You May Enjoy:

First Horizon Bank Bonus: $450 Checking, $800 Biz Checking

First Horizon Bank has a $450 bonus on their checking account with very reasonable qualification requirements. If you’ve been thinking about getting this account, see how you can get a $450 bonus.

Flagstar Bank Promotion: $250-$350 Checking Bonus

Flagstar Bank is offering a new bank bonus for those looking to open a checking account with a direct deposit of just $500.

First Tech Credit Union Promotions: $300 Checking Bonus

First Tech Credit Union has a [acf field=”bonus_amount” post_id=”65588″] bonus offer on their reward checking account. It requires a modest direct deposit and can pay a high APY if you meet certain requirements.

Barclays Bank New Account Promotions: $200 Bonus

These days, Barclays Bank is most known for their online bank because of its competitive rates. If you’re a new customer, can you get a bonus too?

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.