Income taxes can hinder wealth creation. Fortunately, for Americans seeking to save on taxes, there are nine states without income tax where we can choose to reside. These states are listed below in alphabetical order:

- Alaska

- Florida

- New Hampshire

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Ideally, you’ll secure a fantastic job and find your soulmate in one of these nine income tax-free states. As your income grows over the years, you’ll save more by avoiding state income taxes.

When you retire, you probably won’t need to relocate because no income tax usually means tax-free Social Security benefits, IRA or 401(k) withdrawals, and pension payouts. In fact, there are now 41 states that don’t tax Social Security benefits after Missouri and Nebraska decided to stop taxing Social Security benefits in 2024.

If you become wealthy, you can also consider states that don’t tax estates or inheritances. Thankfully, most states without state income taxes also exempt estates and inheritances from taxation.

Therefore, if you want to get rich and save on taxes, it’s beneficial for people early in their careers to study state taxation rates. As you age, regardless of how high the state income tax rate is, it becomes increasingly challenging to move due to the network you’ve established.

High-Paying Jobs Tend To Be In High Income Tax States

Regrettably, most of the highest-paying jobs tend to be concentrated in states with the highest income taxes, such as California, New York, New Jersey, and Connecticut. These states serve as major hubs for industries like technology, finance, and management consulting.

Upon graduating from college, my only job offer came from New York City, where an additional city tax ranging from 3% to 3.87% is imposed. Despite my attempts to secure a consulting position at firms like Deloitte, KPMG, or Andersen Consulting in Virginia, another state with relatively high income taxes, I couldn’t progress beyond the initial interview stages.

While the idea of avoiding state income tax may appear attractive, especially for individuals with high incomes, understand that there’s no free lunch. States without income tax still require revenue to fund vital services like infrastructure, education, and emergency services. This funding is primarily sourced from sales, property, and estate taxes.

If you intend to invest in a home, a crucial step towards long-term wealth accumulation, it’s essential to consider property tax rates across states. Note that states like Texas, Florida, and New Hampshire, which do not collect state income taxes, often compensate through higher property taxes.

I’ve decided to rank the best nine no income tax states into three buckets, from worst to best. The variables include money-making opportunities, weather, other taxes rates, entertainment, food, and culture. The first three variables are more objective than the last.

If you currently reside in one of these no income tax states, I’d love to hear your pros and cons too.

Bucket #3: The Least Attractive No State Income Tax States

Alaska (Republican leaning)

Alaska boasts stunning natural beauty, making it a paradise for nature enthusiasts. However, the state’s harsh winters, limited food variety, sparse entertainment options (such as no major sports teams), and heavy reliance on oil revenues, which account for 85 percent of the state budget, pose significant challenges.

Apart from the oil and gas sector, there are few other lucrative industries in Alaska. You can work in the tourism industry, but it’s hard to get rich, unless you own the leading tourism company.

While Alaska is one of the five states without a state sales tax, local jurisdictions have the authority to impose sales taxes, which can reach up to 7.5%. The average property tax rate in Alaska stands at 1.18%, surpassing the national average. Despite a relatively affordable median home price of around $369,000 in Anchorage according to Zillow, there are no inheritance or estate taxes in the state.

During the summer months, Alaska offers unparalleled attractions, with Denali National Park being a standout destination. However, the state’s isolation and limited availability of high-paying jobs prevent it from being a top choice among no-income-tax states for employment.

South Dakota (Republican leaning)

If you’re a fan of pheasant hunting, South Dakota in the fall is ideal. Likewise, if you enjoy fly-fishing for trout in the Black Hills or fishing in the dammed-up lakes along the Missouri River, which almost bisects the state, you’ll find plenty to appreciate. Additionally, the Black Hills offer excellent opportunities for hiking, mountain biking, and camping for three out of the four seasons.

However, winters in South Dakota are long and harsh. They can begin as early as October, bringing with them weeks of bitterly cold temperatures ranging from -20 to -40 degrees below zero, with wind chills making it feel even colder.

South Dakota’s largest industries by revenue include hospitals, corn, wheat, soybean wholesaling, and meat, beef, and poultry processing, which collectively generated billions of dollars in 2023. But if you’re a regular worker in these industries, it’ll be hard to get rich.You have to own the businesses to make a fortune.

Regarding taxes, the state imposes a 4.5% sales tax. Localities have the authority to add up to an additional 4.5%, resulting in an average combined rate of 6.4%, which falls below the national average.

The average property tax rate in South Dakota is 1.32%, ranking 15th according to the Tax Foundation. Despite this, the median price for a home in Sioux Falls is affordable, standing at only $325,000 according to Zillow. Furthermore, South Dakota does not have inheritance or estate taxes.

New Hampshire (Democrat leaning)

New Hampshire is yet another state that offers fantastic outdoor activities throughout the spring, summer, and fall seasons. From mountains to oceans, lakes and woods, the state is a haven for outdoor enthusiasts. Whether you enjoy hiking, snowboarding, swimming, canoeing, kayaking, hunting, fishing, snowmobiling, ATVing, or taking in the vibrant fall foliage, New Hampshire has it all. Plus, it has a relatively non-humid climate and plenty of sunny days. Everything is a short drive away, including Boston, which is 63 miles away.

In addition to not having a state income tax, New Hampshire does not tax earned income. However, there is currently a 5% tax on dividends and interest exceeding $2,400 for individuals ($4,800 for joint filers). Fortunately, this tax is gradually being phased out, decreasing to 3% in 2024, 2% in 2025, and 1% in 2026, with complete repeal scheduled for January 1, 2027.

On the downside, New Hampshire has an average property tax rate of 2.15%, ranking third according to the Tax Foundation. Therefore, if you’re considering a move to New Hampshire, renting instead of buying may be a more prudent option. However, the state does not impose inheritance or estate taxes.

New Hampshire’s largest industries by revenue include colleges and universities, hospitals, and property, casualty, and direct insurance, which collectively generated billions of dollars in 2023. If these industries don’t align with your interests, finding a high-paying job in New Hampshire may prove challenging.

Bucket #2: The Second Best Group Of States With No State Income Taxes

Tennessee (Republican majority)

Tennessee, a landlocked state in the U.S. South, boasts vibrant cultural hubs like Nashville and Memphis. Nashville, the capital, is renowned for its country music scene, featuring iconic venues like the Grand Ole Opry and the Country Music Hall of Fame. Meanwhile, Memphis is famous for attractions like Graceland and Sun Studio, pivotal to the legacies of Elvis Presley and rock ‘n’ roll.

The state imposes a 7% sales tax, with an additional 2.75% state tax on single item sales ranging from $1,600 to $3,200. Localities can tack on up to 2.75%, resulting in an average combined state and local rate of 9.55%, the second-highest in the nation. However, local taxes are capped, with only the first $1,600 of any single item being taxable.

Property tax rates average 0.75%, ranking 38th according to the Tax Foundation. The median home price in Nashville hovers around $452,000, roughly the national average. However, the median home price in Memphis is only $152,000 according to Zillow! Tennessee does not impose inheritance or estate taxes.

Tennessee experiences varied climates, with mild winters in the western part and cooler winters in the east due to its proximity to the Appalachian Mountains. Nashville typically sees light frosts in January, with average lows of 28°F and highs of 47°F, while Memphis experiences average lows of 33°F and highs of 50°F. Both areas fall within USDA Hardiness Zone 7a, where snowfall is infrequent and rarely lasts more than a few days.

Wyoming (Republican leaning)

When Wyoming comes to mind, Jackson Hole often takes center stage as a ski destination favored by many affluent individuals. I once had a client who moved from San Francisco to Jackson Hole with his wife and triplets to reduce their tax burden.

Wyoming’s allure extends beyond tax advantages; it’s a breathtaking state offering some of the finest outdoor experiences. From the majestic Grand Teton and Yellowstone National Parks, home to iconic landmarks like Old Faithful and Devils Tower, Wyoming is a haven for nature enthusiasts.

The state’s economy is heavily reliant on mining and agriculture, particularly beef cattle and sheep farming. Additionally, Wyoming’s tourism industry is thriving, catering to millions of visitors who flock to its parks and historic sites. However, earning a substantial income in Wyoming can be challenging unless you’re able to work remotely in finance or tech.

Wyoming imposes a 4% state sales tax, with municipalities authorized to add up to 2%, resulting in a combined rate of 5.36%, the seventh-lowest in the nation according to the Tax Foundation.

Property taxes in Wyoming are among the lowest in the country, averaging just 0.61% and ranking 44th. For instance, the median home price in Cheyenne stands at a modest $354,000 according to Zillow. However, in Jackson Hole, where many affluent individuals relocate for tax purposes, the median home price soars to around $2.6 million. Notably, Wyoming does not levy inheritance or estate taxes.

Washington (Democratic majority)

Located in the Pacific Northwest, Washington is known for its rainy and overcast weather, although its summers are typically warm and dry, ideal for outdoor activities. Seattle, often compared to a smaller version of San Francisco, is a hub for high-paying jobs and recreational opportunities.

Despite its appeal, Washington falls short of being a top destination for those seeking states with no income tax, primarily due to its high median home prices. For example, Seattle, where many high-paying jobs are concentrated, boasts a median home price of approximately $890,000 according to Zillow. However, neighboring Tacoma offers more affordable housing, with a median home price just below $500,000.

Washington imposes a 6.50% state sales tax, with a maximum local sales tax rate of 4.10%. The average combined state and local sales tax rate is 8.86%, placing Washington’s tax system 28th overall on the 2023 State Business Tax Climate Index.

Property taxes in Washington average 1.09%, ranking 23rd. The state also levies an estate tax on estates valued over $2.193 million, with tax rates ranging from 10% to 20%. However, there is an exemption threshold adjusted annually for inflation, along with a $2.5 million deduction for family-owned businesses valued at $6 million or less.

Bucket #1: The Best Three States With No State Income Taxes

Finally, we reach the best three states to work and get rich, with no state income taxes. They are Florida, Nevada, and Texas.

Florida (Democratic majority, but very close)

Florida offers a high quality of life with a plethora of attractions and amenities. The state enjoys a warm climate year-round, perfect for outdoor activities like beachgoing, golfing, and boating.

In addition to its natural beauty, Florida boasts vibrant cities such as Miami, Orlando, and Tampa, providing residents with access to excellent dining, entertainment, and arts venues. With numerous parks, nature preserves, and recreational areas, Florida offers abundant opportunities for residents to lead active and fulfilling lifestyles.

The cost of living in Florida is generally lower, with reasonably priced housing options, goods, and services. For instance, the median home price in Miami-Dade County is approximately $600,000, making it an attractive destination for both working professionals and retirees seeking to maximize their retirement savings.

Furthermore, Florida’s homestead exemption offers property tax relief to homeowners, further enhancing its appeal as a retirement destination.

Florida imposes a 6% sales tax, with localities authorized to add up to 2%. On average, the combined sales tax rate stands at 7.02%, placing it in the middle range compared to other states. The average property tax rate is around 1.06%, ranking 25th according to the Tax Foundation.

Getting rich in Florida is more feasible due to a very positive business tax climate and plenty of high-paying jobs in finance, cleantech, defense, IT, and life sciences.

Nevada (Democrat majority)

The state boasts a business-friendly regulatory climate, with minimal red tape and low corporate tax rates. This has led many businesses to establish operations in Nevada, contributing to economic growth and employment opportunities across various industries. The tourism industry remains Nevada’s largest employer, with mining continuing as a substantial sector of the economy: Nevada is the fourth-largest producer of gold in the world.

The state’s natural beauty is showcased through its stunning landscapes, including picturesque deserts, majestic mountains, and tranquil lakes. Outdoor enthusiasts can indulge in activities such as hiking, skiing, and boating, while urban centers like Las Vegas provide world-class entertainment, dining, and nightlife options.

Housing prices in Nevada are generally more affordable, allowing individuals to find suitable housing options within their budget. The median home price in Reno is about $550,000 while the median home price in Las Vegas is only about $420,000.

Additionally, Nevada does not impose inheritance or estate taxes, making it an appealing destination for retirees looking to preserve their wealth for future generations. However, Nevada’s sales tax average is around 8.23%, which is relatively high. So better to buy things elsewhere. Meanwhile, the average property tax rate is only 0.8%, ranked #30 according to the Tax Foundation.

Texas (Republican majority)

Texas offers a thriving economy and ample employment opportunities across various industries. The state’s business-friendly policies, coupled with its robust job market, attract businesses and professionals alike. Texas is home to diverse sectors such as energy, technology, healthcare, and finance, providing a wealth of career prospects for individuals seeking job opportunities or entrepreneurial ventures.

There’s a reason why companies such as Tesla and Oracle have relocated their headquarters to Texas. Meanwhile, Apple is investing billions in a new factor in Texas too.

In addition to its economic advantages, Texas boasts a rich cultural heritage, vibrant cities, and breathtaking natural landscapes. From the bustling metropolises of Houston, Dallas, and Austin to the serene beauty of the Hill Country and Gulf Coast, Texas offers something for everyone. Outdoor enthusiasts can explore its numerous parks, lakes, and trails, while culture aficionados can enjoy world-class museums, theaters, and music venues.

Texas offers a relatively low cost of living compared to many other states, with affordable housing options and a reasonable overall expense profile. The median home price in Houston is only $272,000, $320,000 in Dallas, and $552,000 in Austin according to Zillow. Austin home prices are currently going through a pullback.

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions (cities, counties, special-purpose districts and transit authorities) also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent. Unfortunately, the average property tax rate is 1.9%, #6 rank.

Minorities May Have A Different Point Of View

One common assumption about states without income tax is that they offer a welcoming environment for everyone. However, this isn’t always the reality, particularly for minority communities.

I had a white friend who moved from San Francisco to Tampa Bay after selling his company for tens of millions. He and his white wife adopted three black children and she wanted to be close to her family. Despite their initial excitement, they decided to move back to San Francisco after only ten months.

When I asked why, he explained that his children faced discrimination and bullying in Tampa Bay, which was not as welcoming to minorities as San Francisco, a minority majority city. Cultural attitudes about different people are simply different everywhere you go.

Personally, I’ve felt at ease living in New York City and San Francisco since 1999. These cities are so diverse that I don’t stand out as a Taiwanese Hawaiian person. However, during my time in Williamsburg, Virginia, and visits to other southern cities like Abingdon, I sometimes felt out of place.

While people were generally warm, I encountered racism in high school and college in Virginia. As a result, I’ve gravitated towards more diverse cities over more homogenous ones The racial tension I felt also served as a tremendous catalysts to become financially independent ASAP.

Cities That Require The Highest Income To Afford A House

Now that I’ve ranked the best no state income tax states, it’s time to drill down to the best cities in these states. Once again, determining the best cities in these no income tax states is subjective. However, we can use objective measures to help make a cogent argument.

As someone who wants to earn the most money and build maximum wealth, you want to go to cities with the most high-paying jobs. You also want to live in a vibrant city where there’s lots to do without having to freeze your behind off for three-to-four months a year.

To find the cities in the no income tax states with the highest paying jobs, we can do a back-of-the-envelope analysis by finding which cities require the highest incomes to afford a home. After all, high incomes and high home prices go hand in hand. The reason why homes are expensive in the first place is because of the income and wealth opportunities available to its residents.

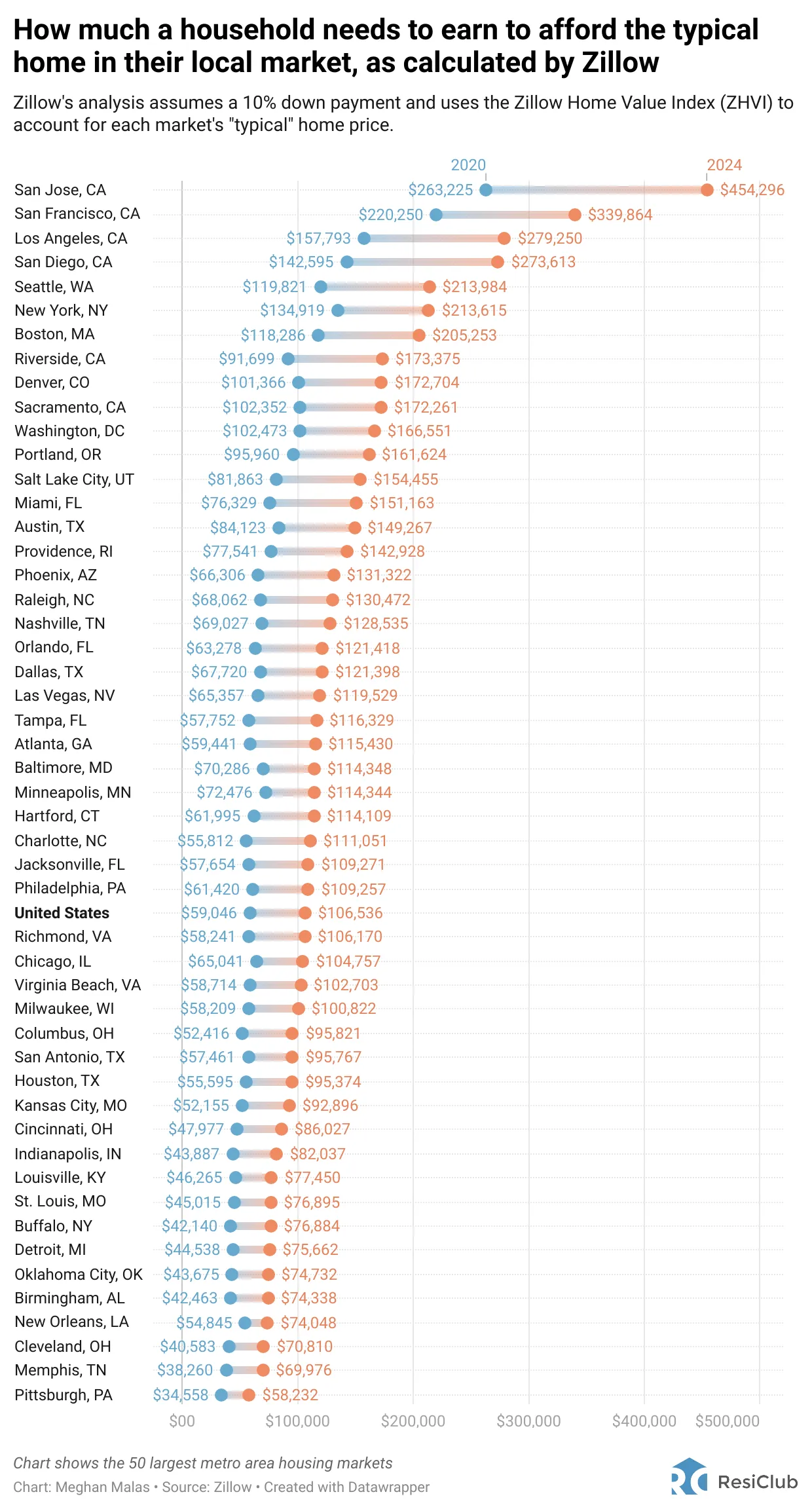

As a reminder, below is a chart that depicts how much a household needs to earn to afford the typical home in their local market, based on data from Zillow.

Top American Cities To Get Rich And Pay No State Income Taxes

To identify the best cities, we just identify the highest income requirements cities within the nine no-income-tax states. They are:

- Seattle, WA ($213,984)

- Miami, FL ($151,163)

- Austin, TX ($149,267)

- Nashville, TN ($128,535)

- Orlando, FL ($121,418)

- Dallas, TX ($121,398)

- Las Vegas, NV ($119,529)

- Tampa, FL ($116,329)

- Jacksonville, FL ($109,271)

I stop at Jacksonville because any other city in the nine no-income-tax states falls short of the United States median income of $106,536. I’m looking for cities with the most robust income opportunities in the country.

Seattle Is The Best No Income Tax City To Earn The Most

Seattle stands out as the premier metropolis without state income taxes. What distinguishes it? The heavy hitters—Amazon, Microsoft, Starbucks, Deloitte, Providence Health, and many other influential players call it home. Though the weather may not suit everyone, if it’s good enough for Bill Gates, it’s certainly worth considering for the rest of us.

Miami takes second place as a no-income-tax city, having attracted tech talent and venture capitalists. However, the post-pandemic allure toward Miami has waned, as entrepreneurs and investors recognize the positive network effects of cities like San Francisco and New York.

In third place is Austin, drawing in new businesses and migrants from pricier locales such as San Francisco and Los Angeles. It’s a magnet for big names like Tesla and Oracle, enticing them to relocate their headquarters. At one point during the pandemic, it seemed like everyone was moving to Austin.

Upon reflection, I believe these three cities offer the most robust job opportunities with the highest pay. Whether you’re part of the majority or a minority, these cities have something to offer everyone.

Choose The Best Job First, Best City And State Second

While the appeal of avoiding state income taxes may be tempting, prioritize finding the best job opportunity first. If that happens to be in one of the top no state income tax states, consider it a bonus. However, if not, you can always explore relocation options after gaining more experience.

With remote work becoming increasingly common post-pandemic, the opportunity to move to a no state income tax state has expanded. But it’s wise to make such a move before committing to buying a house, choosing schools for your children, and establishing strong social connections. Once these aspects are in place, relocation becomes more challenging.

Upon retirement, relocating to a no income tax state may seem appealing. However, since your income is likely to be lower in retirement, the tax savings may not be as significant as when you were working. At this stage, the move may only be worthwhile if you’re motivated by factors like being closer to grandchildren or enjoying better weather.

Hard For Me To Relocate After Being In San Francisco Since 2001

Personally, I value living in a city with a moderate climate that enables me to enjoy outdoor activities year-round. As an avid tennis and pickleball player, I can’t do freezing temperatures during the winter. And if it does snow, then there had better be a fantastic mountain to ski on close by!

Cities like San Francisco, Los Angeles, San Diego, and Honolulu are among my favorites, despite their high tax rates. Fortunately, Hawaii doesn’t tax Social Security and pension income.

While I could potentially save money by moving to Austin or Seattle, I have no desire or need to do so. My friends are here in San Francisco, and my family resides in Honolulu. Additionally, passive investment income is taxed at a more favorable rate. Therefore, I’m content where I am.

However, for younger individuals or those with substantial wealth, making a move now to save on taxes could be a wise decision. Unless life becomes unbearable in a high-income tax state, you’ll likely adapt to paying higher taxes and find ways to make the best of the situation.

Reader Questions

Which is your favorite no state income tax state and why? Which do you think are the best states for retirement? Are you willing to relocate to a no income tax state to save? If you have, I’d love to know how difficult the move and the adjustment was. What are some of the downsides of living in a no income tax state? If you currently reside in one of the nine no state income tax states, I’d love to get more of your point of view!

As people become more mobile thanks to technology, more people should logically migrate to a no income tax state. Therefore, I think it’s worth investing in real estate in the best cities in the no income tax states. To do so, check out Fundrise, a private real estate investment platform that began in 2012. It primarily invests in lower-cost cities with higher rental yields. I am personally an investor in Fundrise funds.

For superior cash flow management and net worth tracking, explore Empower, a free wealth management tool I’ve trusted since 2012. Empower goes beyond basic budgeting, offering insights into investment fees and retirement planning. Stay on top of your finances because there’s no rewind button in life.